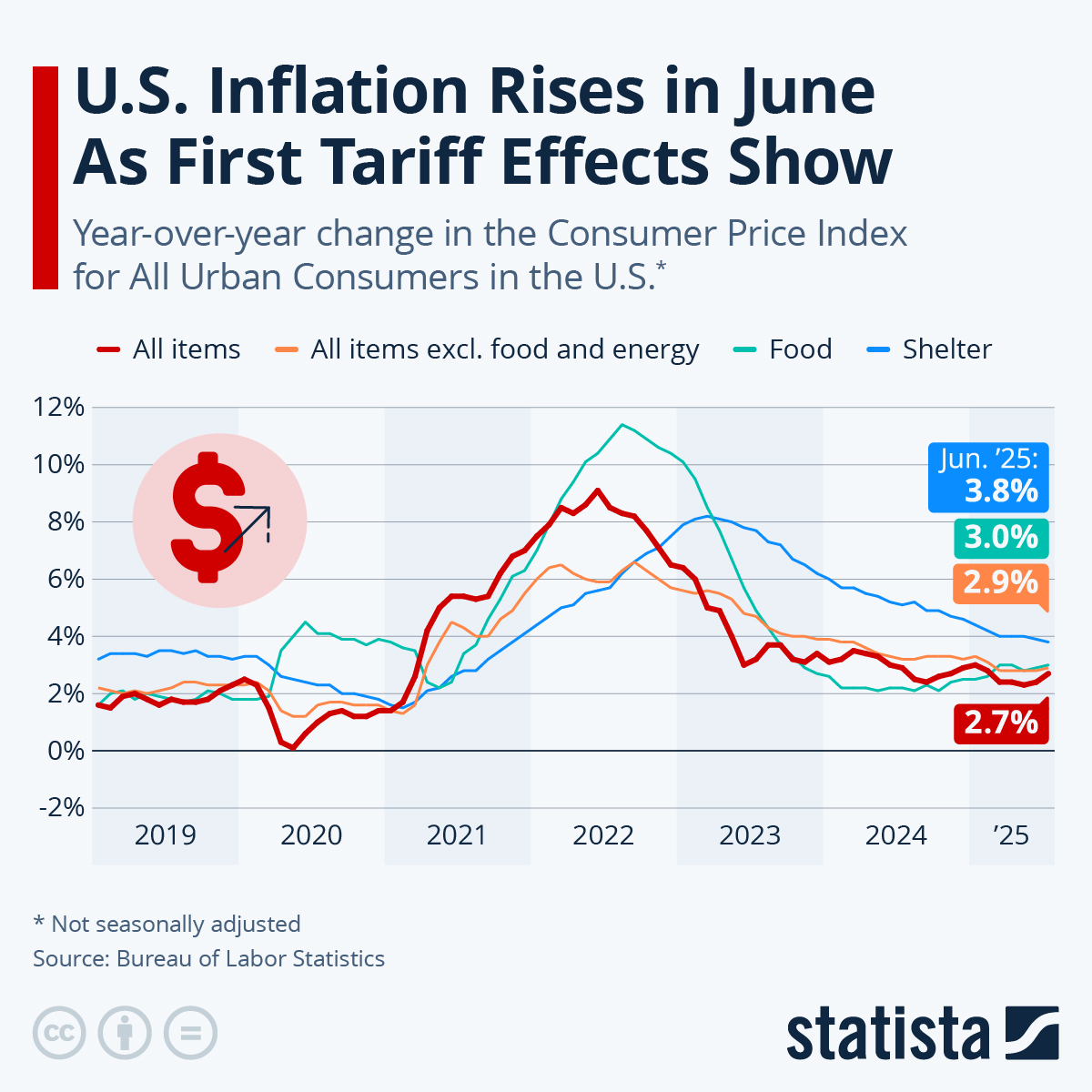

Just a few days after President Donald Trump announced a new 25-percent tariff on steel and aluminum, the latest CPI report - the first since Trump took office last month - showed that the fight against inflation is not over yet. According to new data published by the Bureau of Labor Statistics on Wednesday, the Consumer Price Index for All Urban Consumers (CPI-U) increased 3.0 percent over the last 12 months before seasonal adjustment, meaning that inflation has now heated up for four consecutive months after hitting a three-and-a-half year low in September 2024. Perhaps more worryingly, prices increased 0.5 percent month over month, marking the highest monthly increase in prices since August 2023.

According to the Bureau of Labor Statistics, the index for shelter alone accounted for nearly 30 percent of the monthly all items increase, as housing costs increased 0.4 percent in January. Due to its weight in the Consumer Price Index - shelter is by far the largest expenditure category in the virtual goods basket - housing costs continue to be a major driver of inflation. Rents and owners' equivalent rents of residences increased 4.2 and 4.6 percent year-over-year in January, respectively, as the index for shelter climbed for the 57th consecutive month. In fact, excluding the impact of shelter, inflation would been at or below the Fed's target level of 2 percent in 16 of the past 20 months, illustrating that housing costs have been the most stubborn driver of elevated inflation lately.

While President Trump has called for more rate cuts in a social media post on Wednesday, the latest uptick in inflation combined with the statements made by Fed chairman Jerome Powell earlier this week make it unlikely for the Fed to lower rates in the near future. "We do not need to be in a hurry to adjust our policy stance," Powell had said in his semi-annual testimony to Congress, referring to robust growth, a strong labor market and still elevated inflation. The latest inflation reading all but cemented the belief that the Fed will pause rate cuts at its March meeting after lowering the federal funds rate by a total of 100 basis points at its last three meetings of 2024. According to the CME FedWatch Tool, there's now a 97.5 percent probability of the Fed keeping its policy rate as it is in March and an 85.5 percent chance of the same, aka nothing, happening at the Fed's meeting in May. Given the current situation, it seems unlikely that rates will be lowered further before the second half the year, especially as some of Trump's policies, e.g. raising tariffs and deporting undocumented immigrants, are feared to add rather than ease inflationary pressures.