The value of intangibles like intellectual property rights associated with inventions and brands, customer data and software continue to grow, as businesses increasingly depend on technology and innovation to compete.

According to long-time purveyor of intangible asset trends, Ocean Tomo, intangibles now comprise 90% of the value of S&P 500 companies. This leaves tangibles, such as buildings, equipment and real estate making up just 10% of the Index’s company value.

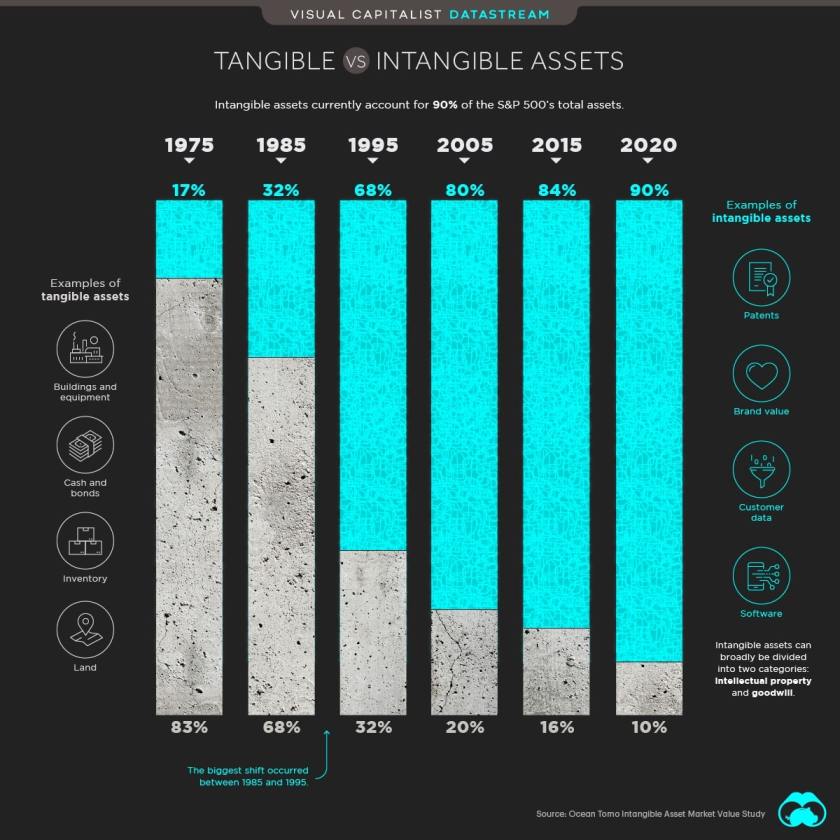

Over the last 35 years, the percentage of intangible asset value of the S&P 500 has almost tripled (see graph). From 1985 to 1995 intangible asset value more than doubled, from 32% to 68%. After that, it has been a steady upwards stream. 2015 to 2020 saw another 6% jump, from 84% to 90%.

“There are reasons to suggest that influence of tech and thus intangible assets has more steam in its engine,” reports Visual Capitalist. “The looming 5G revolution, more internet users on the horizon, and the powerful potential of new technologies are all supporting considerations.”

$21 Trillion

According to a 2018 study by risk management and insurance business, Aon, as reported in IP CloseUp, intangible assets have come to represent $21 trillion, more than five times that of tangibles, like real estate and equipment.

“Over the past half century, we have witnessed a somewhat silent revolution in terms of what factors are really driving business valuations,” reports Forbes. “As the global economy has gradually shifted away from an industrial base and focuses more on services and knowledge, enter the age of intangible asset, as an increasingly vital component of corporate worth.”

Image source: VisualCapitalist.com

Goood reading

LikeLike