MARKET NEWS

Biscardi joins MarketAxess

Experienced bond trader Tom Biscardi has been appointed senior open trading specialist at MarketAxess.

The trading platform reported US$42.9 billion in total average daily volume...

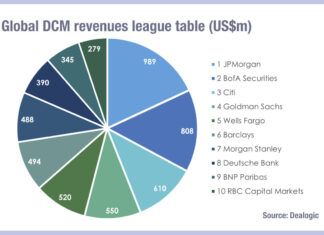

JP Morgan leads Q1 trading results, Dimon calls for deregulation

JP Morgan raced ahead of competitors in fixed income trading revenues over the first three months of 2025, reporting over US$1 billion more than...

ICE chases Tradeweb in MBS electronic trading

ICE aims to get a bigger pie of the electronic Mortgage Backed Securities (MBS) trading market and introduces a new anonymous Request-for-Quote (RFQ) protocol.

Intercontinental...

US rates activity explodes post-tariffs

Tariff tumult in the US Treasuries market saw average daily notional volume spike over March, up 31% year-on-year (YoY) to US$1.089 trillion at the...

US credit trading reached record highs pre-tariffs

The corporate bond market was already at record levels before the US tariffs came into force, FINRA data shows.

US credit trading volumes reached record...

S&P and CME offload OSTTRA to KKR

S&P Global and CME Group have agreed to sell their post-trade solutions business OSTTRA to global investment firm KKR.

The US$3.1 billion enterprise value deal...

FEATURES

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

PROFILES

RESEARCH

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

FROM THE ARCHIVES

TransFICC launches fixed income consolidated tape pilot

TransFICC, the specialist provider of low-latency connectivity and workflow services for Fixed Income and Derivatives Markets, has launched a new initiative to develop a...

European Market Choice Awards: Bridging the gap

Reaching across buy- and sell-side has won popular support for TS Imagine in connecting front offices.

TS Imagine has won the votes of traders on...

Erik Tham leaves UBS Wealth for MarketAxess

Erik Tham has joined MarketAxess as head of Private Banking, for Benelux and Switzerland, leaving his position as executive director at UBS Wealth Management,...

On the DESK : Cathy Gibson : Royal London

The buy side must be an active participant in shaping market structure if investors are to achieve the best returns, says Cathy Gibson.

Biography: Cathy...

FILS 2021: AxeTrading integrates ICE pricing and analytics

AxeTrading, the fixed income trading software company, has demonstrated the integration of ICE’s leading pricing, analytics and market data into the AxeTrader Quoting and...

J.P. Morgan: Finding the best path in e-trading fixed income

Electronic trading may resolve key structural challenges in the market for buy-side traders, including instrument selection, with guidance from key dealers.

Chinedum Nzelu, head of...

Liquidnet signs up to the Sustainable Trading initiative

Market operator Liquidnet, part of the TP ICAP Group, has joined a member of Sustainable Trading, a non-profit membership network dedicated to supporting environmental, social...

Bloomberg onboarded over 100 buy-side firms remotely during the pandemic

Bloomberg has reported that more than 100 clients globally implemented its buy-side solutions over the past year, between March 2020 and 2021. During the...

Citi boosts EGB rates trading team across US and Europe

Citi has made a number of appointments to its rates trading team, with Courtenay Watson joining the company as a managing director in London.

Watson...

Tigress network “maximises” ESG footprint with ICE bond platform partnership

Intercontinental Exchange (ICE), a global provider of technology and data, has partnered with Tigress Financial Partners, a disabled and women-owned financial advisory firm, to...

S&P Global: European bonds slump to lowest first-half volume since financial crisis

By Thomas Beeston

European high-yield bond issuance is set for the lowest first-half total since the global financial crisis, as volatile interest rates and fears...

New flexible data offerings – Eugene Grinberg

Eugene Grinberg, Solve Advisors Co-Founder and CEO, tells The DESK how the firm’s acquisition of Advantage Data and Best Credit Data will support better decision-making...